Add ad hoc Credit

The Ad Hoc Credit slide-over lets youcreate credit transactions. You can use this when you need to:

- Issue a credit for incorrect or duplicated billing (e.g. you billed a client twice for a procedure)

- Sync and create credit notes in Xero to reverse charges on invoices

How Ad Hoc Credits Work

If you need to manually reverse or adjust a charge that does not come from those automatic processes, you can create an Ad Hoc Credit.

Credits can be added from:

- Horses → Bulk Action

- Horse Profile → Transactions tab

- Financials → Transactions

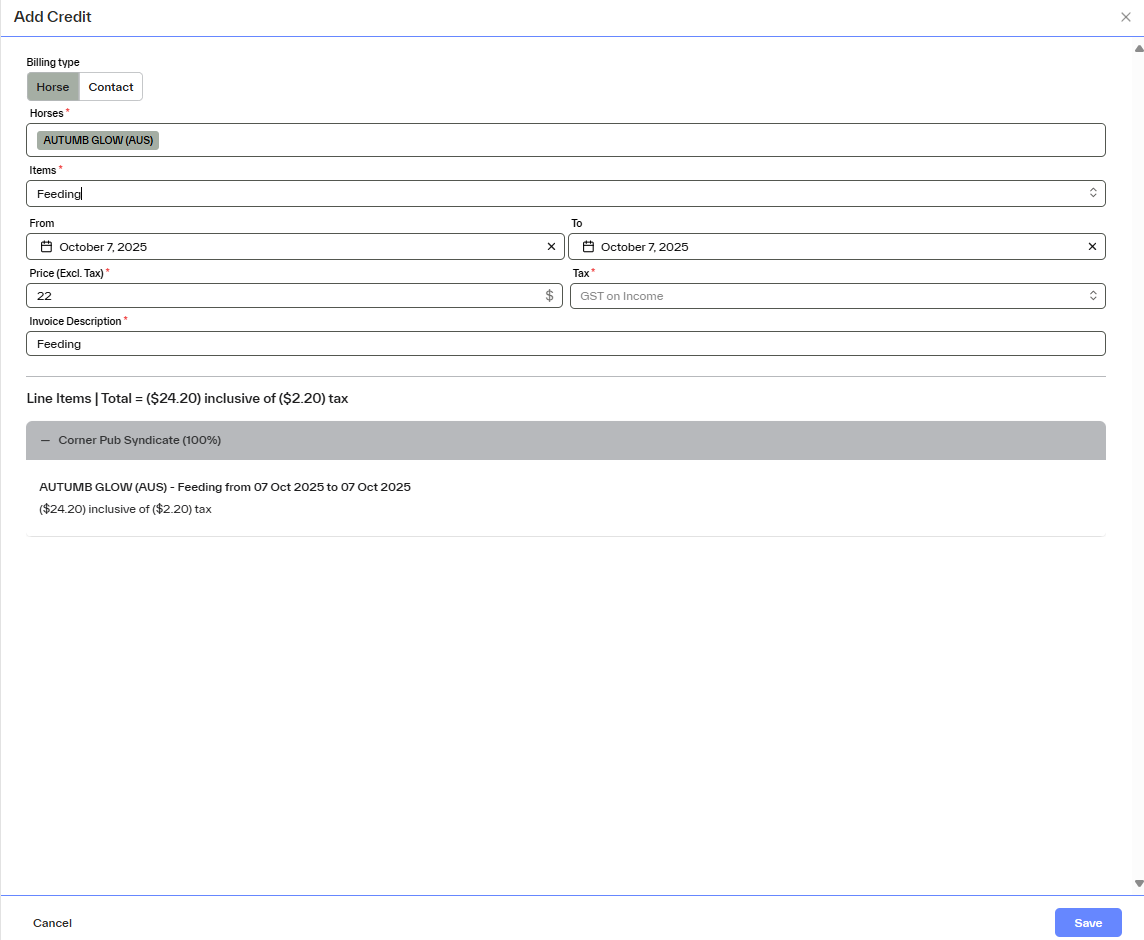

Add Credit

When adding a credit, first select whether it applies to a Horse or a Contact:

Horse → the credit will split across all billable contacts.

Contact → the credit will apply to that contact directly (you may optionally link it to a horse).

You can select one or multiple horses when creating credits.

Choose the right Item Type

The Item Type determines which fields you can edit and how the credit behaves.

1. Sales Account Code

Use this when you want full flexibility to create a custom credit.

Editable fields:

Price (excl. tax) → unit amount to credit

Quantity → number of units

Tax rate → select the correct tax rate

Amount and Total → automatically calculated

Description → appears on the credit note line in the invoice

🟡 Note: The Discount field is not available for credits.

When saved, this credit will appear as a Transaction Subtype = Credit and display a yellow badge.

Amounts will display in brackets to indicate a negative value.

2. Daily Charge

Select this option to create daily-based credits (e.g. refunding daily charges for a date range).

All fields are prefilled from the selected product or service (except for tax, which cannot be edited).

You’ll need to choose From and To dates to generate daily credit entries for each day in the range.

3. Other Fees

Use this for credits unrelated to horses (non-procedure items), such as reversing arena hire, agistment extras, or admin fees.

Depending on the Unit of Measure (UOM) configured for the item:

If Daily → you’ll see From and To date fields to calculate the daily credits.

If Each → you’ll see the Quantity field instead.

All fields will be prepopulated as per configuration, except for the tax (which remains fixed).

✅ Review and Save

Once you’ve entered all the credit details:

A summary of invoice line items will display at the bottom of the modal, showing the breakdown of credit amounts (in brackets).

Review the details carefully and Save.

If you selected multiple horses, the summary will show a table with the credit created for each horse, instead of individual line items.

When the invoice is generated, these credit transactions will create credit note line items in the invoice and sync to Xero accordingly.